Boost Your Tax Benefits

Click on the tabs below to learn how each of these strategies can provide tax benefits to you.

To make a gift to be certified for the Colorado Child Care Contribution Tax Credit (CCCTC), click here.

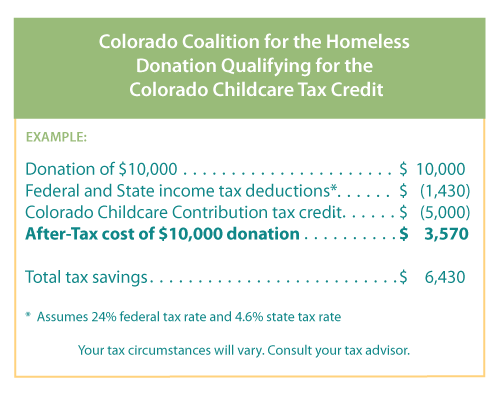

Your cash gift can qualify for a Colorado state tax credit, reducing your state tax bill by 50% of the amount of your gift. Please indicate “CCCTC” on your check or in the comments when making a gift online so we know you’d like us to certify your gift for this credit. Here’s an example of how your CCCTC can benefit your taxes:

*Gifts made via Donor Advised Funds are not eligible for this credit.

*Please contact your tax advisor about the relationship between Qualified Charitable Distributions and state tax credits.

The Colorado Homeless Contribution Income Tax Credit provides a tax credit to Colorado taxpayers that contribute to eligible homelessness related projects within Colorado, such as the Colorado Coalition for the Homeless. Please note the following information about qualifying for this credit.

Qualifying Gifts

- Cash gifts of $500 or more

- Stock or in-kind gifts of more than $5,000

Requirements to claim credit:

- The state requires taxpayers to provide the last four digits of the taxpayer's Social Security Number (SSN) or Individual Taxation Identification Number (ITIN) to the nonprofit in order to certify the gift with the state. For businesses, the taxpayer's full Federal Employer Identification Number (FEIN) is required. Please contact us at (303) 312-9673 to provide this information or provide in the comments when making a gift online.

- It is required for taxpayers to file electronically for smoother and more accurate tax credit processing.

- The total value of tax credits allowed per taxpayer per year may not exceed $100,000.

To make a gift to be certified for the Homeless Contribution Tax Credit, click here.

*Gifts from a Donor Advised Fund are not eligible for this credit.

*Please contact your tax advisor about the relationship between Qualified Charitable Distributions and state tax credits.

If you have questions about these credits, please call (303) 312-9673 or email us for gift planning support.

The Coalition gratefully accepts gifts of publicly traded securities. It is easy to transfer securities directly from your brokerage account. Donating appreciated securities before they are sold typically provides helpful tax benefits:

- You can claim the current market value of your stock as a charitable deduction for tax purposes.

- You pay no capital gains tax on the stock's appreciated value.

- Stock gifts valued over $5,000 can qualify for the Homeless Contribution Tax Credit for 25% of the donation.

Colorado Coalition for the Homeless Stock Transfer Details

Fidelity Investments (800-343-3548)

For Credit To: Colorado Coalition for the Homeless

Account Number: Z50-669288

DTC Number: 0226

Taxpayer Identification Number: 84-0951575

Important: A direct stock transfer from your brokerage account will not include your name or other personal information. Because of this, please email us at giving@coloradocoalition.org or call (303) 312-9673 to alert us of your stock gift so we can prepare a timely receipt for your donation.